Unlocking The Secrets: Decoding Nancy Pelosi's Investment Success

The world of finance is often a complex labyrinth, but when a prominent political figure consistently outperforms seasoned investors and even top hedge funds, it naturally sparks widespread curiosity. The spotlight has increasingly fallen on **Nancy Pelosi investments**, particularly the remarkable returns achieved by the former House Speaker and her husband, Paul Pelosi. This phenomenon has led many to closely monitor their financial moves, prompting questions about how such consistent success is possible and what it might mean for the average investor.

This article delves deep into the intriguing world of Nancy Pelosi's portfolio, exploring the strategies, the sectors, and the ethical considerations that come with tracking the investments of a high-profile public servant. We'll break down her recent investments, historical performance, and the ethical risks associated with her notable success, providing a comprehensive overview for anyone interested in this unique intersection of politics and finance.

Table of Contents

- The Phenomenon of Following Political Figures' Trades

- Who is Nancy Pelosi? A Brief Biography

- Decoding Nancy Pelosi's Investment Portfolio

- Astounding Returns: Outperforming Wall Street Giants

- Recent Bets: A Look at Key Nancy Pelosi Investments

- The Ethical Quandary: Should You Mirror Nancy Pelosi's Stocks?

- Transparency and Accountability in Political Investments

- Beyond the Headlines: What Investors Can Learn

The Phenomenon of Following Political Figures' Trades

In the intricate dance of the stock market, investors are constantly seeking an edge. For some, that edge surprisingly comes from tracking the investment activities of prominent political figures, particularly those in powerful legislative positions. The rationale is straightforward: these individuals, by virtue of their roles, may possess unique insights into upcoming legislation, policy changes, or economic shifts that could significantly impact various industries and companies. This perception, whether accurate or not, fuels a distinct interest in their trading patterns.

- Mybookie Login

- Final Fantasy Restoration Magic

- Campbell Basketball

- Sonder The Craftsman

- News 12 Brooklyn

The interest in **Nancy Pelosi's stock trades** is a prime example of this phenomenon. The former House Speaker and her husband, Paul Pelosi, have garnered significant attention for their consistently strong investment returns. It's not just casual observation; "some investors follow Nancy Pelosi's trades because of the notable returns she and her husband have achieved." This isn't merely about curiosity; it's about the potential to replicate success, even if the underlying reasons for that success remain a subject of debate and scrutiny.

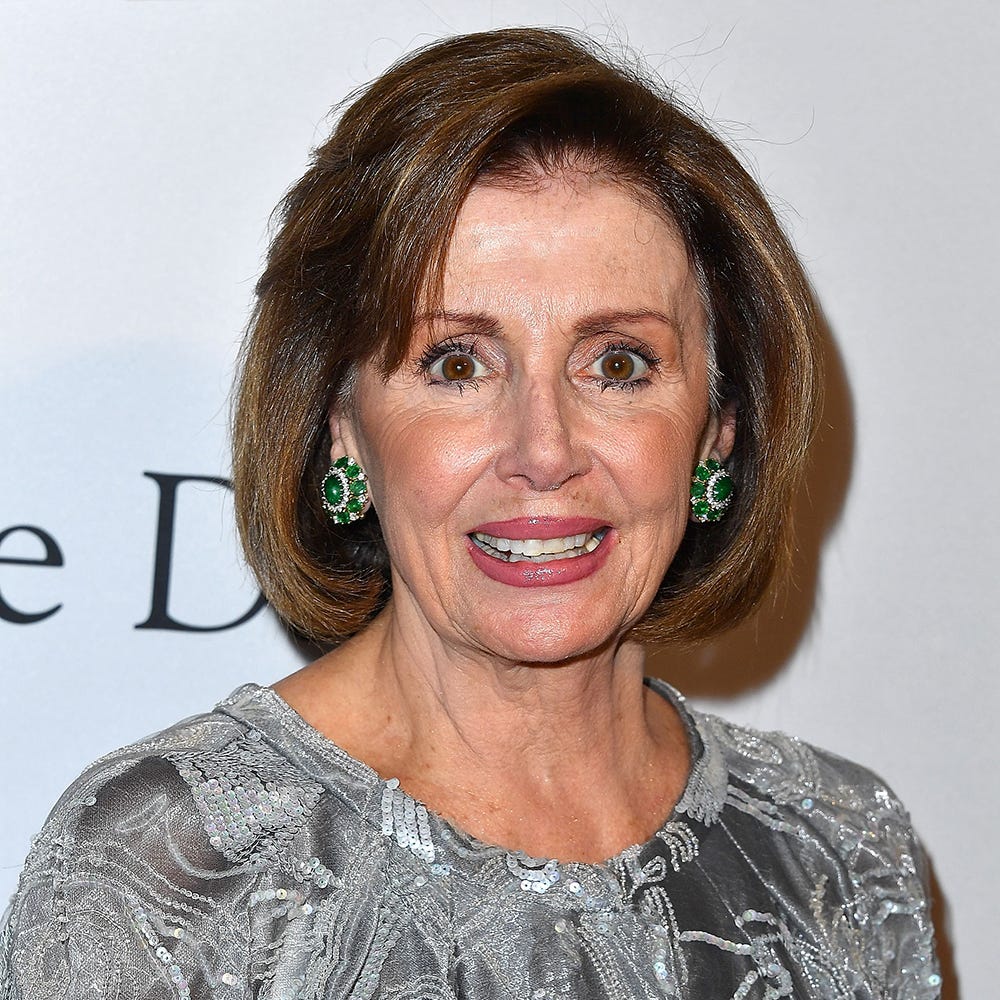

Who is Nancy Pelosi? A Brief Biography

Before diving into the specifics of her financial endeavors, it's essential to understand the individual at the center of this investment discussion. Nancy Patricia D'Alesandro Pelosi is an American politician who served as the 52nd Speaker of the United States House of Representatives from 2007 to 2011 and again from 2019 to 2023. As the first woman in U.S. history to hold the speakership, she was the highest-ranking female elected official in the country. Her career in public service spans decades, representing California's 12th congressional district (and previously the 8th) since 1987. Her long tenure and influential positions have given her unparalleled access to information and a deep understanding of the legislative process, which some argue might contribute to her family's investment prowess.

Personal Data and Biodata Table

For a quick overview of Nancy Pelosi's key personal and professional details:

| Category | Detail |

|---|---|

| Full Name | Nancy Patricia D'Alesandro Pelosi |

| Date of Birth | March 26, 1940 |

| Place of Birth | Baltimore, Maryland, U.S. |

| Spouse | Paul Francis Pelosi (m. 1963) |

| Children | 5 |

| Political Party | Democratic |

| Education | Trinity College (B.A.) |

| Primary Occupation | Politician (Former Speaker of the U.S. House of Representatives) |

| Years in Congress | 1987–Present |

Decoding Nancy Pelosi's Investment Portfolio

The core of the public's fascination lies in understanding "what’s inside Nancy Pelosi’s portfolio." A "Nancy Pelosi stock tracker" essentially serves as a list of stocks invested by the former Speaker of the U.S. House of Representatives and her husband. While the full, real-time details of every single transaction are not always immediately public, financial disclosure forms provide a window into their holdings and trading activities. These disclosures reveal a significant leaning towards specific sectors and companies.

Generally speaking, Nancy Pelosi is heavily invested in the technology sector. Her portfolio, along with major stocks that have been publicly reported, holds giants of the industry. This focus on technology is consistent with many successful investors in recent decades, given the sector's rapid growth and innovation. However, the sheer scale and timing of some of these investments have drawn particular attention, especially when they precede significant legislative developments impacting the tech industry.

The types of companies found within Nancy Pelosi's investment strategy often include household names that dominate their respective markets. This approach suggests a preference for established, large-cap companies with strong market positions, rather than highly speculative ventures. While this strategy is sound for long-term growth, the consistent outperformance raises questions about the specific timing and selection of these already robust assets.

Astounding Returns: Outperforming Wall Street Giants

Perhaps the most compelling aspect of the interest in **Nancy Pelosi investments** is the sheer magnitude of their financial success. Reports have consistently highlighted that Nancy Pelosi has delivered solid returns, and these returns have even surpassed those of the top hedge funds and investors like Warren Buffett over certain periods. This claim is not made lightly; financial analysts and journalists have scrutinized public disclosure data, finding that the Pelosi family's portfolio has indeed shown remarkable growth.

For instance, reports indicate that Nancy Pelosi and her husband, Paul Pelosi, achieved astonishing investment gains in 2024, outpacing major hedge funds and the S&P 500. This level of outperformance is rare, even for professional money managers with dedicated teams and vast resources. The S&P 500 is a benchmark for the broader market, and consistently beating it, let alone top-tier hedge funds, suggests either exceptional market timing, superior stock picking, or a combination of factors that are not immediately apparent to the average investor.

The scale of these gains fuels both admiration and skepticism. On one hand, it showcases a shrewd investment acumen. On the other, it intensifies the debate around the ethical implications of politicians trading stocks, especially when their legislative duties might intersect with the financial performance of the companies they invest in. This extraordinary track record is a primary driver for those who seek to "track Nancy Pelosi's stock trades" in hopes of mirroring her success.

Recent Bets: A Look at Key Nancy Pelosi Investments

While the overall portfolio composition is important, the most recent moves often capture the most attention. Investors are keen to know where she has recently "bet big on," as these indicate her latest insights or convictions. Public disclosures provide snapshots of these recent purchases, offering clues into the evolving landscape of Nancy Pelosi's investment strategy.

While specific real-time details are subject to disclosure timelines, past reports have highlighted significant investments in leading technology companies. Here are examples of the types of companies that have appeared among Nancy Pelosi and her husband's stock purchases, illustrating their preference for established tech giants:

- Alphabet (GOOGL/GOOG): As mentioned, Alphabet is the parent company of Google and YouTube and is a global leader in online advertising, search engines, and cloud computing. Investments in Alphabet represent a stake in one of the world's most dominant and diversified technology conglomerates.

- NVIDIA (NVDA): A leading designer of graphics processing units (GPUs) for the gaming and professional markets, as well as chipsets for the automotive market and artificial intelligence. NVIDIA's growth has been explosive, particularly with the rise of AI.

- Microsoft (MSFT): A diversified technology giant with strong positions in operating systems, cloud computing (Azure), business software (Office 365), and gaming (Xbox).

- Apple (AAPL): The world's most valuable company, known for its consumer electronics, software, and online services.

- Amazon (AMZN): A global e-commerce and cloud computing leader (AWS).

- Tesla (TSLA): A pioneer in electric vehicles and clean energy.

These examples illustrate a consistent focus on companies at the forefront of technological innovation and market leadership, aligning with the general observation that her portfolio is heavily weighted towards the technology sector.

Deep Dive into Specific Holdings

Taking Alphabet as a prime example, an investment here signifies confidence in the continued dominance of digital advertising and cloud services. Google's search engine maintains a near-monopoly, and YouTube is the world's largest video platform. These are businesses with immense moats and consistent revenue streams. Similarly, a significant bet on NVIDIA, especially in recent years, would have capitalized on the boom in artificial intelligence and data centers, where NVIDIA's chips are crucial. These are not speculative penny stocks but established, high-growth companies that require substantial capital to invest in significant quantities.

The Ethical Quandary: Should You Mirror Nancy Pelosi's Stocks?

The impressive returns generated by Nancy Pelosi's investments inevitably lead to a critical question for many retail investors: "Should you invest in Nancy Pelosi stocks?" This question opens up a complex discussion involving not just financial strategy but also significant ethical considerations. We break down her recent investments, historical performance, and the ethical risks of her success, urging caution and independent thought.

The primary ethical concern stems from the perception of potential conflicts of interest. As a powerful legislative figure, Nancy Pelosi had access to information regarding proposed legislation, economic forecasts, and industry-specific policies that could directly impact the stock market. While there are rules in place to prevent insider trading, the proximity to such information, even if not directly acted upon illegally, creates an appearance of impropriety that undermines public trust. This is particularly true when lucrative trades precede major legislative actions or announcements that benefit the invested companies.

Navigating the Perception of Insider Trading

The STOCK Act of 2012 (Stop Trading on Congressional Knowledge Act) was enacted to combat the perception and reality of insider trading by members of Congress. It explicitly affirmed that members of Congress and their employees are not exempt from insider trading laws and required them to disclose stock transactions within 45 days. Despite this, the timing of some Pelosi family trades has led to public scrutiny and accusations, even if no illegal activity has been proven. The issue isn't always about explicit insider trading but about the "information asymmetry" – the idea that politicians have an inherent advantage due to their roles.

The challenge lies in distinguishing between legitimate, informed investing based on publicly available information and leveraging non-public, privileged insights. Without direct evidence of illegal activity, it's difficult to prove wrongdoing. However, the constant public debate highlights a fundamental tension between a politician's right to invest and the need for absolute public trust in their legislative impartiality.

Risks and Rewards of Following Political Trades

For the average investor considering mirroring **Nancy Pelosi investments**, the risks far outweigh the potential rewards. Firstly, you do not have the same information. By the time a politician's trade is publicly disclosed, the market may have already reacted, or the optimal entry point may have passed. Secondly, market timing is notoriously difficult, and what worked for one investor at a specific moment may not work for another. Blindly following trades without understanding the underlying fundamentals or your own financial goals is a recipe for disaster.

The "rewards" are purely speculative: the hope of catching a ride on a successful trade. However, this strategy ignores diversification, risk tolerance, and long-term financial planning. It also implicitly endorses a system where politicians' personal financial gains are viewed as a blueprint for public investment, which raises its own set of ethical questions about the integrity of public service.

Transparency and Accountability in Political Investments

The ongoing discussion around **Nancy Pelosi investments** and those of other politicians has brought the issue of transparency and accountability in congressional stock trading to the forefront. There are growing calls for stricter rules, including outright bans on individual stock trading for members of Congress and their immediate families. The argument is that such a ban would eliminate the perception of conflicts of interest and restore public faith in the legislative process.

Currently, the public can "track Nancy Pelosi's stock trades, net worth, portfolio, corporate donors, proposed legislation and more" through various public databases and financial disclosure forms. However, the delayed nature of these disclosures (up to 45 days) means that by the time a trade is public, the opportunity to replicate it perfectly has often vanished. Critics argue that this delay still allows for an unfair advantage and that more immediate, or even pre-approval, disclosure requirements are needed.

The debate also extends to the broader influence of "corporate donors" and how their contributions might align with legislative outcomes or even the personal investments of politicians. While direct links are hard to prove, the interconnectedness of these elements contributes to the public's desire for greater scrutiny and more stringent ethical guidelines for those in power.

Beyond the Headlines: What Investors Can Learn

While the allure of high returns from **Nancy Pelosi investments** is undeniable, the most valuable lesson for the average investor lies not in replication but in understanding fundamental investment principles. The Pelosi family's portfolio, heavily weighted in the technology sector and holding giants like Alphabet, demonstrates a belief in long-term growth trends and investing in dominant companies. This strategy, focusing on quality assets, is a cornerstone of sound investing.

Instead of blindly following, investors should:

- Conduct Your Own Research: Understand the companies you invest in, their business models, and their long-term prospects. Don't rely on someone else's trades.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Spread your investments across different sectors and asset classes to mitigate risk.

- Focus on Long-Term Goals: Short-term trading based on public figures' disclosures is speculative. A well-thought-out long-term strategy aligned with your financial goals is more sustainable.

- Understand Risk Tolerance: Every investment carries risk. Be aware of how much risk you are comfortable taking.

- Stay Informed, But Be Skeptical: Follow financial news and political developments, but critically evaluate information, especially claims of "guaranteed" success from following others' trades.

Ultimately, the story of Nancy Pelosi's investment success serves as a powerful reminder of the potential for significant wealth accumulation in the stock market, but it also highlights the critical need for transparency, ethical conduct, and independent decision-making in the world of personal finance.

Conclusion

The fascination with **Nancy Pelosi investments** is a microcosm of broader societal interests in wealth, power, and transparency. Her and her husband's astonishing investment gains, particularly in the technology sector, have undeniably captured public attention, even surpassing the returns of seasoned Wall Street professionals. This remarkable performance, while impressive from a purely financial standpoint, has simultaneously ignited fervent debates about the ethical implications of politicians' stock trading and the potential for perceived conflicts of interest.

While the allure of mirroring such success is strong, the prudent path for the average investor involves focusing on sound, long-term investment principles, conducting thorough personal research, and maintaining a diversified portfolio. The narrative around Nancy Pelosi's portfolio serves as a powerful case study, not just in investment returns, but also in the ongoing dialogue about accountability, transparency, and trust in public service. What are your thoughts on the intersection of politics and personal finance? Share your insights and perspectives in the comments below, or explore our other guides on building a robust investment strategy.

Detail Author:

- Name : Laurence Parker

- Username : liana.kozey

- Email : kdubuque@strosin.com

- Birthdate : 1970-01-05

- Address : 65001 Fay Key Suite 061 Lake Hipolito, NJ 71855

- Phone : +18572789989

- Company : Bartell-Homenick

- Job : Platemaker

- Bio : Sunt laborum repudiandae et ab quam. Rerum officiis reprehenderit mollitia quia. Facere dolores sapiente dicta ad sed.

Socials

twitter:

- url : https://twitter.com/o'konm

- username : o'konm

- bio : Perferendis qui ex facilis rem. Et magni facilis voluptatum dolore autem.

- followers : 549

- following : 1789

facebook:

- url : https://facebook.com/o'kon2012

- username : o'kon2012

- bio : Minus aut dolorem aliquid dignissimos quisquam accusantium qui.

- followers : 4576

- following : 1564

linkedin:

- url : https://linkedin.com/in/mo'kon

- username : mo'kon

- bio : Ut rerum officia tenetur.

- followers : 5328

- following : 901

instagram:

- url : https://instagram.com/o'kon2006

- username : o'kon2006

- bio : Voluptatem ut suscipit eligendi ea. Nemo ipsam laborum cum odio. Rem nisi sint voluptatem.

- followers : 5497

- following : 773